Some investors have taken a look Trade‘s (Nasdaq: TTD) The results of the fourth quarter criticized the sales button. The digital advertising expert missed the Wall Street consensual income income target for the first time since the company became public in 2016. The title closed 33% down the next day, erasing a year of flashing gains on the market. Currently, the stocks of the commercial office are down 50% compared to its annual peak.

In my eyes, it is an invitation wide open to buying this higher quality growth stock. It is still not a cheap stock, negotiating at 90 times the ends of the end and 14 times sales. But it is well broken down recent peaks, with Price / benefit ratios (p / e) Often arranged above 200 and sales figures (P / S) briefly throwing above 30. Thus, from a historical point of view, the actions of the commercial office seem quite affordable at the moment.

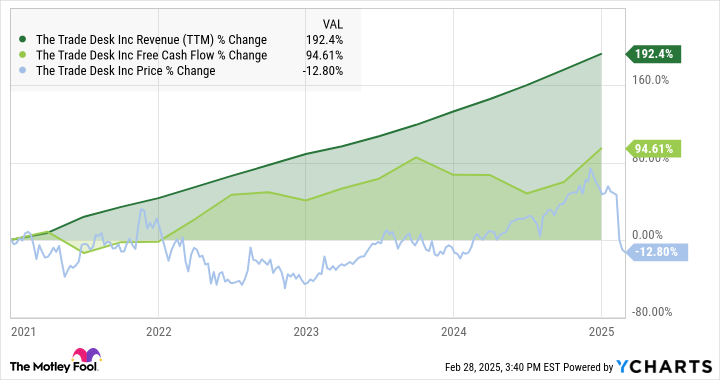

And you cannot forget the massive growth potential of the company. Remember the inflation crisis that led to a lower market in 2022? The actions of the Trade Desk followed the market below, but you would not have guessed only if you were looking at the business results of the company. The Blue Price Table in the graph below shows you the action of the market, but do you even see a slowdown in sales growth of the commercial office? Meanwhile, his cash benefits continued to bend up:

Thus, the free annual cash flow flows of the Commerce Office have approximately doubled in four years, while income has almost tripled. The stock is 12% cheaper during the same range.

Yes, the company has disappointed investors of slow sales growth and modest prospective advice in the last report on results. The brutal reaction of the market, however, seems to be inappropriate. The rare Revenue Miss was an income intake of 22.3% from one year to the next, exceeding only a growth target of 25.2%.

Management has done exactly the right thing. CFO Laura Schenkein took the “full property” of the Miss income on the Fourth quarter of winnings. This was not a missed opportunity but a relatively low execution period. In response, the Trade Desk presented a detailed plan of 15 points to launch the growth of endless sales. Action points include partnerships, audio advertisements, hires in the sales department and a modified process for product development.

The trade of trade does not take this slowness in stride. The company takes resolved measures to get back on the right track.

I cannot promise that the challenges of the commercial office will disappear in 2025, and some investors would say that the stock remains too expensive, even now. However, you pay a premium for a high octane growth actions. This wins an additional gold star for its positive income and cash flow – many companies with the metal pedal tend to accumulate basic losses until they are ready to slow down and collect profits.