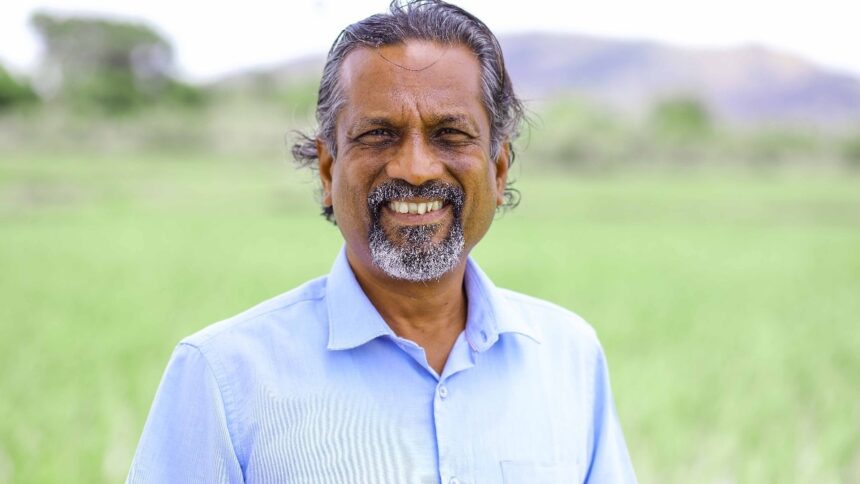

The founder of Zoho, Sridhar Vembu, raised a red flag on the economic model of China, calling it “fundamentally defective” and unsustainable. In an article on X, Vembu criticized China’s relentless pressure in the cost of domestic consumption, arguing that its “export at all costs” strategy forces other nations to import excess – a system which he doubted can survive for 25 years.

VEMBU’s comments have been triggered by an article emphasizing how China has not yet reversed the drop in its share of consumption since Zhu Rongji’s economic reforms and the entrance to the WTO.

Zhu Rongji reforms reshaped the Chinese economy through the restructuring of SOEs, the modernization of the financial sector and market liberalization. His policy of Zhuada Fangxiao has consolidated large public companies (public enterprises) while privatizing smaller, improving efficiency but resulting in millions of job losses. In banking services, he created asset management companies to manage poor loans and encouraged banking privatization to introduce competition in the market.

Zhu’s tax sharing system, modeled on the American federal structure, has increased central income and rationalized budget management.

On the world level, Zhu played a decisive role in the entry of the WTO in China in 2001, opening the markets and reducing commercial barriers. It has also reduced prices, strengthening the Chinese economy focused on exports. At the national level, he half reduced the bureaucracy, luminating ineffectiveness and corruption. Although its policies have triggered significant layoffs, they stabilized inflation, strengthened the financial sector and fueled rapid economic growth, cementing the position of China as a global power.

Calling the “original sin” of this China, Vembu argued that the country has created a structurally unbalanced economy which only survived by the expansion of endless debt.

“The only way in which this system has” balanced “is to constantly increase debt (and therefore money, because money itself is someone else’s debt in our pure fiat system supported by money and nothing). In a healthier monetary system, imported nations have literally” eaten (or) “so that they cannot continue to import,” he wrote.

This is not the first time that VEMBU has sounded an alarm on economic imbalances. He also warned against the excessive statement of India, arguing that his domination “sucked in all oxygen” from other critical industries such as basic manufacturing and engineering.

“When money pours into an industry too quickly, it sucks resources and can leave us less capacity than before in other critical sectors that are neglected during the flood of money,” he said, comparing financial bubbles to “sudden floods”.

His remarks struck an online rope, triggering discussions on the over-concentration of talents at this price at the price of other areas. A user deplored: “There is not a single child who wants to opt for non -hardcore engineering branches, unless he has no other options. Long -term damage to neglected manufacturing is real. »»