(Bloomberg) – Asian actions have increased for a third day, supported by the progress of Japanese actions and that investors have put new bets on Chinese technological companies.

Most of Bloomberg

The references of Hong Kong Equity outperformed in Asia with gains of approximately 2%, stimulated by the actions byd Co. to a record after having unveiled a new load system for electric cars. Japanese gauges were up more than 1%. It was after American actions climbed for a second day, while industrial and energy actions gathered.

The stock market rally around the world can obtain a new catalyst from a series of technological gains, with Xiaomi Corp. and tencent Holdings Ltd. which will present themselves this week. While the Beijing briefing on strengthening consumption has been considered disappointing by some, Tuesday’s market reaction suggests that investors remain positive on prospects. Byd’s technological advancement also strengthens a story of the global competitiveness of Chinese companies.

Things point to a slowdown in the United States, but in China “the direction of travel seeks to stimulate growth,” said Richard Harris, founder and CEO of Port Shelter Investment Management, on Bloomberg TV. “So, I’m very in the corner of the say, we are looking at the big pivot of the United States in China at the moment.”

The yield on treasury bills at 10 years has changed little after slipping a base point at 4.30% on Monday. The Bloomberg Dollar spot index bordered above. US actions have slipped into trade in Asia.

In Japan, the actions of the largest commercial houses gathered after Berkshire Hathaway Inc. increased his participation. Financial shares also obtained high returns before the Japanese bank decision on Wednesday. The central bank should maintain the policy rate at 0.5%, according to economists interviewed by Bloomberg.

“The Boj must look closely at the steep gains in yields,” said Junki Iwahashi, Sumitomo Mitsui Trust Bank. “Particular attention will be justified on Ueda’s comments on this subject when he speaks to the briefing,” he said, referring to the Governor of Boj.

In other news, President Donald Trump said that the Chinese leader Xi Jinping would soon go to Washington, as part of the baking tensions between the two biggest economies in the world.

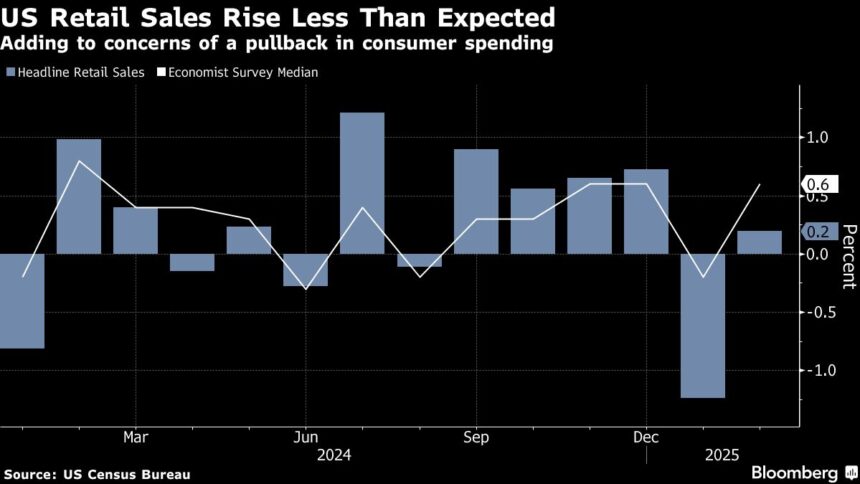

Retail sales

The S&P 500 and the NASDAQ 100 increased by around 0.6% each on Monday, because the gains of small capitalization actions prevailed over a slide in the magnificent seven cohort.

American retail sales increased less than scheduled in February and the previous month was revised below. However, the so -called sales of control groups – which fuel the government’s calculation by the expenses of goods for gross domestic product – increased by 1% last month, reversing the previous decline.

“Although the chattering of recession may seem exaggerated for the moment, the American economy remains on a slowdown trajectory, keeping assessments under a meticulous examination,” said Jun Rong Yeap, market strategist at IG Asia.

A feeling of waiting can emerge from decision -makers this week, in their first assessment of how Trump’s trade policies have an impact on the economy. On Wednesday, Fed officials are expected to have rates, the market will focus on the updated economic projections of officials and the president of the president of Jerome Powell for indices on the future.

Meanwhile, oil stabilized after a two-day gain, the prospects of the Chinese economy and the geopolitical risk in the Middle East remaining to the point. Gold held the ounce almost $ 3,000.

Key events this week:

-

Starting American housing, import price index, industrial production, Tuesday

-

Decision of the Rates of the Bank of Japan on Wednesday

-

Decision of the rate of the federal reserve on Wednesday

-

Loan bonus in China, Thursday

-

Decision of the rates of the Bank of England on Thursday

-

US Philadelphia fed factory index, unemployed claims, existing house sales, Thursday

-

Consumer confidence in the euro zone on Friday

-

Fed’s John Williams speaks on Friday

Some of the main market movements:

Actions

-

Tower contracts on S&P 500 dropped from 0.2% to 10:43 a.m.

-

The Topix of Japan increased by 1.6%

-

Australia S&P / ASX 200 increased by 0.3%

-

Hang of Hong Kong increased by 1.9%

-

Composite Shanghai increased by 0.2%

-

Euro Stoxx 50 Contracts in the long term increased by 0.4%

Currency

-

The Bloomberg Dollar Spot index has changed little

-

The euro has changed little at $ 1,0915

-

The Japanese yen dropped 0.2% to 149.48 per dollar

-

The Yuan Offshore has changed little at 7.2318 for a dollar

Cryptocurrency

-

Bitcoin dropped from 1% to $ 83,091.42

-

Ether dropped from 1.7% to $ 1,903.01

Bonds

-

The yield on treasury bills at 10 years has changed little at 4.29%

-

Japan yield at 10 years old was unchanged at 1.505%

-

The yield in 10 years in Australia has decreased a basic point to 4.40%

Goods

-

West Texas’s intermediate crude has changed little

-

Gold at point increased by 0.1% to $ 3,004.85 per ounce

This story was produced with the help of Bloomberg Automation.

– With the help of Paul Allen, Haidi Lun and Winnie Hsu.

Most of Bloomberg Businessweek

© 2025 Bloomberg LP