The stock market has performed incredibly well in 2024 and the S&P500 is up 25% since the start of the year. Fortunately for investors looking to put capital into the market, things calmed down in December, with the S&P down 1% month to date. Looking even deeper, some companies are facing challenges that have driven down their stock prices.

Hoping for a stock price discount is only part of the equation in finding the best stocks to buy. Investors should also look for companies with competitive advantages and a strong track record of success. Short-term challenges have created opportunities to buy shares of these two companies at a discount.

For investors with $1,000 to invest in the market, buying one or both of these stocks could be a wise decision.

If you opened a PDF file, you used a Adobe (NASDAQ:ADBE) product. Although this ubiquitous file type is Adobe’s best-known application, it’s the company’s creative suite that is the main driver of the bottom line. Products like Photoshop and Premiere Pro are industry standards in creative fields, although competition has intensified over time.

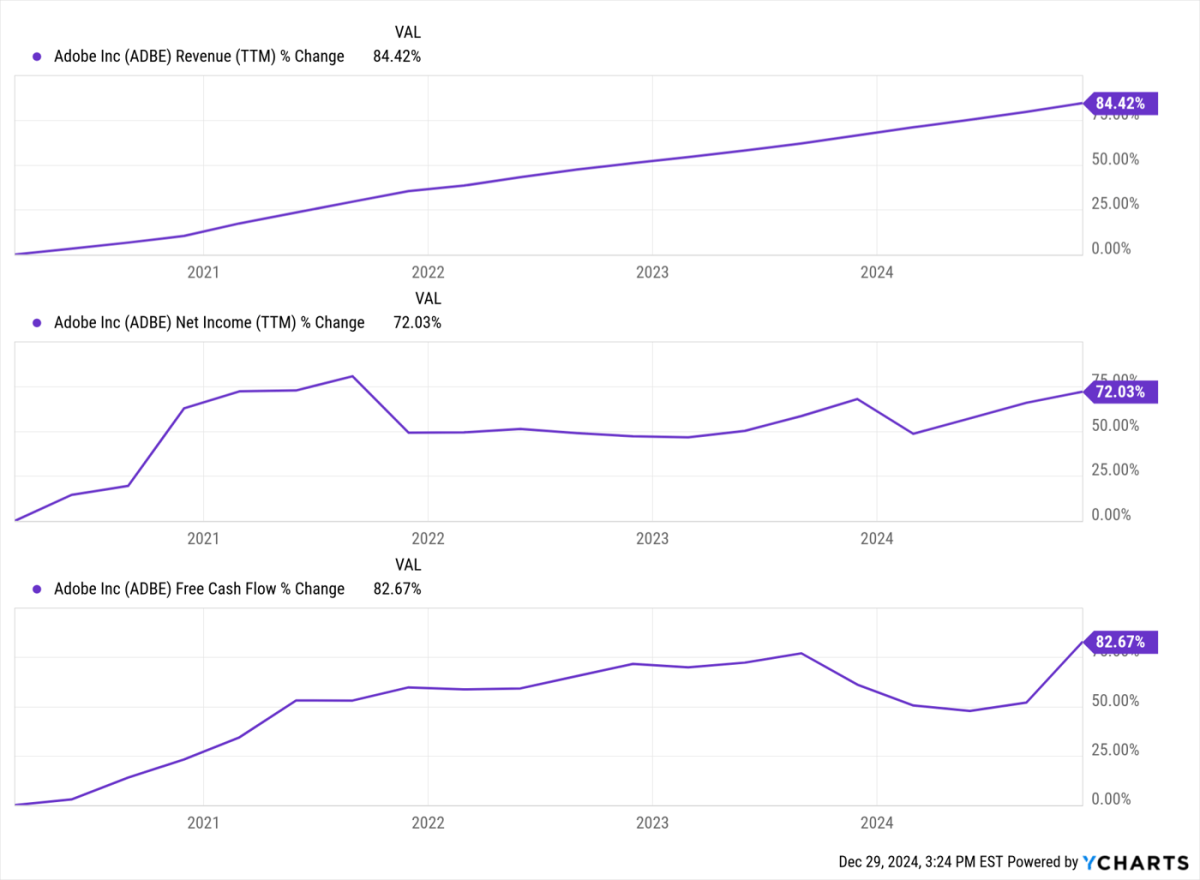

Proof of Adobe’s market position is evident in its financial results. Like all businesses, there are sometimes short-term hurdles, but over the long term, Adobe has been remarkably consistent. Consider revenue, net profit and free cash flow over the last five years.

Even though Adobe’s track record is impressive, investment is a question of the future and the biggest potential disruption to Adobe’s market dominance is artificial intelligence (AI). Many of the tasks that creators would perform in Adobe products can already be done by AI, and AI’s capabilities are growing every day.

Adobe chose to embrace this new technology and worked hard to integrate its AI product, Firefly, into its software suite. Rather than viewing AI as a replacement for Adobe products, the company believes it can be an assistant in the creative process by taking over some of the more menial tasks, freeing up the creator to be creative.

Time will tell how effective this strategy will be, and the market appears to be waiting to find out. Adobe currently trades at a price-to-earnings (P/E) ratio of 36. While that’s not a cheap multiple, it’s lower than Adobe’s five-year average P/E ratio of 47. For Investors who believe Adobe will be able to harness the power of AI, rather than be disrupted by it, the current price could prove to be a bargain.

A bit like Adobe, a Dutch manufacturer ASML (NASDAQ: ASML) is the leader in its sector. ASML manufactures the lithography machines needed to manufacture all semiconductor chips. When it comes to the most advanced semiconductors, ASML is the only company in the world manufacturing the extreme ultraviolet (EUV) lithography machines needed for these cutting-edge chips.