The year 2025 is off to a strong start. Inflation rates last month were modest and the three largest stock indexes were up year to date as of January 16. The stock market has generally been climbing recently, with technology stocks leading the trend. bull market.

However, not all tech stocks have seen impressive price gains. Some of my favorite stocks in this sector are currently trading well below their 52-week highs, but their business prospects still look excellent. Given these divergent trends, you should consider purchasing some Roku (NASDAQ:ROKU) And MongoDB (NASDAQ:MDB) actions in January.

Here’s why.

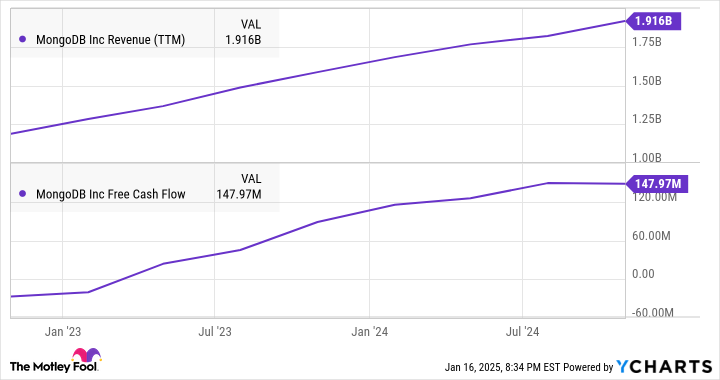

Let’s start with MongoDB. The next-generation database software expert’s sales have increased 49% over the past two years. Free cash flow jumped 520% over the same period:

However, MongoDB stock has only gained 25% during this period. To put this performance in context, the S&P500 (INDEXSNP: ^GSPC) increased by 49% and the Nasdaq Composite (NASDAQ INDEX: ^IXIC) was up 75%.

The database expert’s chart includes a 29% decline since Dec. 9, 2024. The company reported third-quarter results that day, beating Wall Street consensus estimates by 73%, while Revenues were 6% above analysts’ average target. The stock fell further the next day as longtime CFO Michael Gordon also announced his resignation. The company also offered modest guidance for the next quarter, but that should be less exciting because MongoDB has a history of lowering its earnings forecasts.

And Gordon leaves on good terms. He continues to give presentations at investor conferences and the topic of his departure hasn’t even come up. Instead, Gordon spent most of this fireside chat emphasizing how healthy the demand is for MongoDB’s ultra-flexible database solutions. In particular, the cloud-based Atlas database is becoming a popular data manager for large-scale projects. artificial intelligence (AI) projects.

I admit that MongoDB stock is not cheap based on traditional metrics. At the same time, the company achieved its price-to-earnings ratio of 74 times by growing sales at a compound annual rate of 45% over the past five years. The recent drop in stock prices looks like a wide open buying window.

Roku’s story is strikingly similar to MongoDB. Many investors saw it as a play on the coronavirus-related lockdowns of 2020, pushing the high-flying market into Wall Street’s bargain basement in 2022 and 2023. The stock has mostly floated sideways since then, including a 19% drop in prices in the typically booming market year of 2024.