Listen and subscribe to Opening Bid at Apple Podcasts, Spotifyor wherever you find your favorite podcasts.

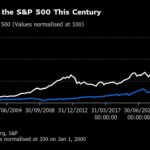

If you follow today’s hottest stocks, like the Magnificent Seven, you’ve probably been eager to see them rise.

However, “I think it’s a lot like the Internet and the dot-com era,” the Bridgewater Associates founder cautioned. Ray Dalio in a conversation with the editor-in-chief of Yahoo Finance Brian Sozzi for the Opening Bid podcast (watch video above or listen below). The two sat down for a chat at the World Economic Forum in Davos, Switzerland, and Dalio delivered insights ranging from leadership to his personal investing mantras.

Dalio benefits from five decades of market experience. He founded Bridgewater in 1975 and grew the company from a scrappy operation where he ran a two-bedroom apartment to a company ranked by Fortune as the fifth-largest privately held company in the United States.

Known in the industry for sticking to a custom set of principles and sharing them widely, Dalio is the author of several works on the subject. His latest book, “How Countries Go Bankrupt: Principles for Navigating the Big Debt Cycle, Where We Are Going and What We Should Do,” is due out in September.

Rather than piling it all into the hot stocks of the day, Dalio advised investors to consider greater diversification by investing in 10 to 15 “good, uncorrelated, risk-balanced return streams.” Calling this strategy “the holy grail and…mantra in investing,” he told Sozzi: “If you achieve this mantra, you will make a fortune.” »

“Everyone asks what the best debt is,” he continued. “They don’t realize that with diversification, the first three diversified and relatively uncorrelated assets will cut the risk almost in half. This means you double your return/risk ratio.

Dalio also noted that this type of strategy often requires patience when deploying, which can be difficult in a buzz-generating environment. “The game is about not going out,” he said. “The nature of the loss [is]you lose 50%, you have to win 100% to get it back.

For the persistent investor with $1,000 to invest, Dalio advised thinking about the difference between alpha and beta.

“Alpha is a zero-sum game,” he said. “To get alpha, you have to take it away from someone else. Beta means there is an asset class.

But even before diversification, his first advice to investors is to demonstrate humility.

“Be humble, like in any game [where] you’re competing,” he said.

His final piece of advice is to evaluate headline-grabbing, buzz-generating investments. “Get away from the idea that investments that have performed well recently are better investments rather than more expensive. You need to know the difference between an investment that has increased significantly and [that’s] well done. »