(Bloomberg) – Deepseek breakthrough in artificial intelligence helps bring back a rotation of stock funds in China from India.

Most of Bloomberg

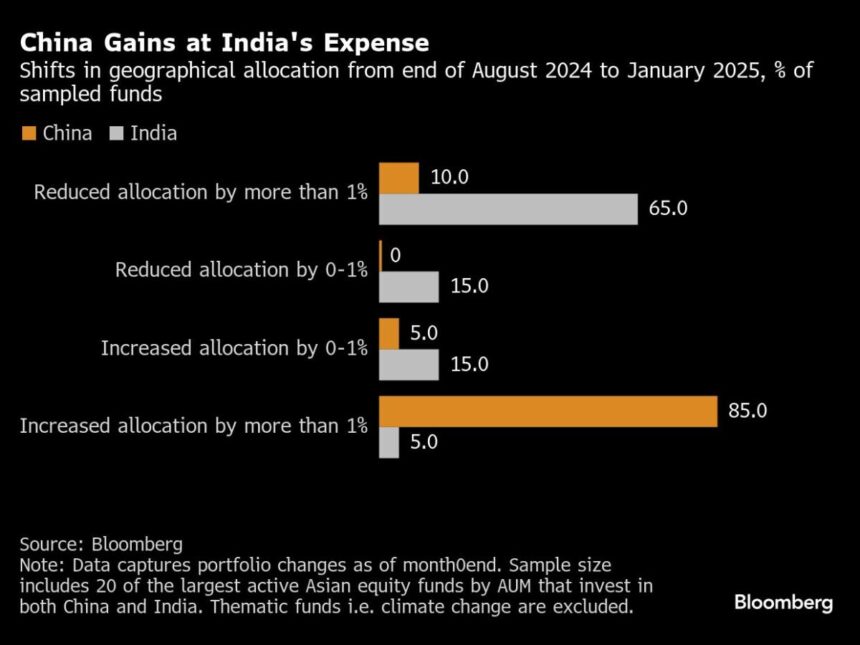

The hedge funds have stacked Chinese actions at the fastest rate for months, because a technological rally focused on depths adds to hopes for more economic stimulus. On the other hand, India suffers from a record exodus of liquidity on the concerns concerning the decline of macro-growth, the slowdown in the profits of companies and the evaluations of costly actions.

The onshore and offshore stock markets in China added more than $ 1.3 billion of total value in the middle of such reallocations last month, while the India market has decreased by more than $ 720 billion . The MSCI China index is on the right track to surpass its Indian counterpart for a third consecutive month, the longest sequence of these two years.

Deepseek has shown “that China has in fact companies that form an essential element in the entire AI ecosystem,” said Ken Wong, specialist in Asian action portfolio at EastSPring Investments. His business has added Chinese Internet assets in recent months, while reducing small Indian stocks which had “exceeded their multiple evaluation”.

The rotation marks a tower of the pivot to India seen in recent years, attracting funds away from China. This was based on the follies of infrastructure expenditure in India and its potential as an alternative manufacturing center in China. India focusing on the country has also been considered a refuge relating to the middle of Donald Trump’s pricing plans.

China seems to find its old attraction on a fundamental reassessment of its investment, especially in technology. After having frightened investors with corporate repressions not long ago, Beijing can actually help push the new theme of AI, as the news indicates that entrepreneurs, including the co-founder of the co-founder Alibaba Holding group, Jack Ma, were invited to meet the main leaders of the country.

Deepseek developments are likely to stimulate the Chinese economy as well as its markets, offering a prolonged boost, said Vivek Dhawan, fund manager at Candriam. “If you put all the parts together, China becomes more attractive than India in the current configuration on a risk basis.”

The evaluation differential is also added to the appeal of China. The MSCI China index is negotiated at only 11 times the estimates of long -term profits, compared to about 21 times for the MSCI India index.