(Bloomberg) – It was not supposed to take place in this way. A little more than a year ago, optimism about Indonesia was high, investors expecting Prabowo to suffer the pro-business policies of former president Joko Widodo.

Most of Bloomberg

Instead, they are now struggling with changing priorities, because the costly social protection plans of Prabowo express the country’s finances and threaten to undermine economic activity. These concerns contributed to a rout in the actions of the country on Tuesday, arousing the first negotiation stop from the pandemic and encouraging the Central Bank to defend the Rupiah.

“People expected the new president to continue with this program, and they saw a transition to a new priority,” said Thea Jamison, Director General of Exchange Global Investment LLC. “And this priority is not yet really defined and articulated.”

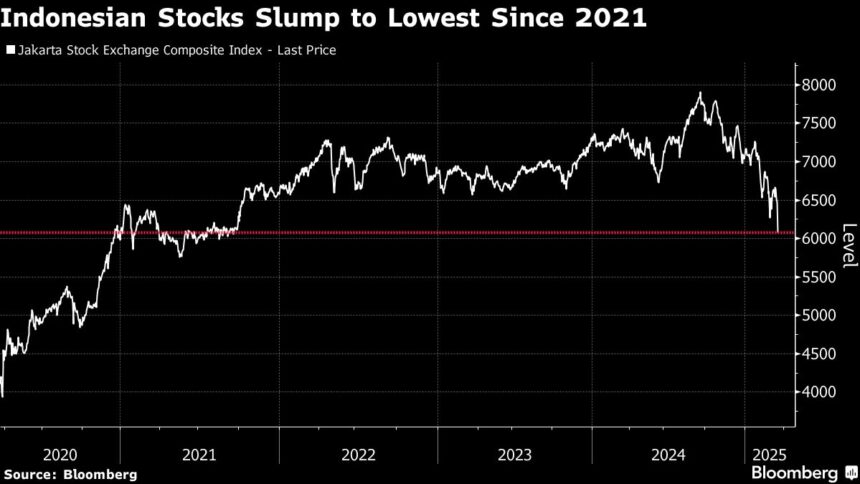

The turmoil has added doubts to the investmentitability of the largest equity market in Southeast Asia, which is down 21% compared to a peak in September. Tuesday’s action was also fueled by speculation on the Minister of Veteran Finance, Sri Mulyani Indrawati, potential resignation.

While Indrawati vehemently dissipated rumors, speculation came at a precarious moment. There are concerns about the health of public finances of Indonesia, including a budget deficit at the start of the year and a 20% drop in state revenues. The prospects remain uncertain in the midst of unclear budgetary allowance plans and a lack of new income -generating measures.

Investors are now obliged to weigh, that the sale was a blip or a sign of things to come.

The Jakarta Composite reference index was approximately 1% more Wednesday, erasing a brief sale at the market open. Investors have also obtained a little good news from the country’s securities regulator, which has adapted the shareholding rules for the next six months.

But the Indonesia stock market remains one of the least efficient in the world, and investors still have disturbing questions about the approach of the current government.

“Foreign investors are clearly shaken by Prabowo’s disturbing signals on budgetary reallocates and the ability of the Ministry of Finance to maintain the overall budgetary discipline,” said Macro-Stutrege Main at Lombard Odier Ltd.

Prabowo sought to divert funds in its priority projects, while reducing expenses elsewhere. Danantara, who has a direct report line to the president. Control of the company on companies making up more than a fifth of the JCI index has aroused fears of political risks and transparency.