The panelists “The Claman Countdown” Scott Bauer and David Lebovitz unpacking market volatility and the sale of Big Tech.

Nvidia forecasts Income in the first quarter Above market estimates on Wednesday, expecting high demand for its main ia chips to persist while businesses spend heavily to extend generating artificial intelligence infrastructure.

Its shares flowed approximately 1% in the spent spent discussed, after closing 3.7% in regular exchanges. NVIDIA is the largest beneficiary of a Gathering in AI stocks related to AI, with its shares of more than 400% in the past two years.

Due to the effort to crawl the flagship product of the company Blackwell ai chips, The raw margins of the first quarter forecast of NVIDIA takes place at 71%, below the forecasts of 72.2% by Wall Street, according to data compiled by LSEG.

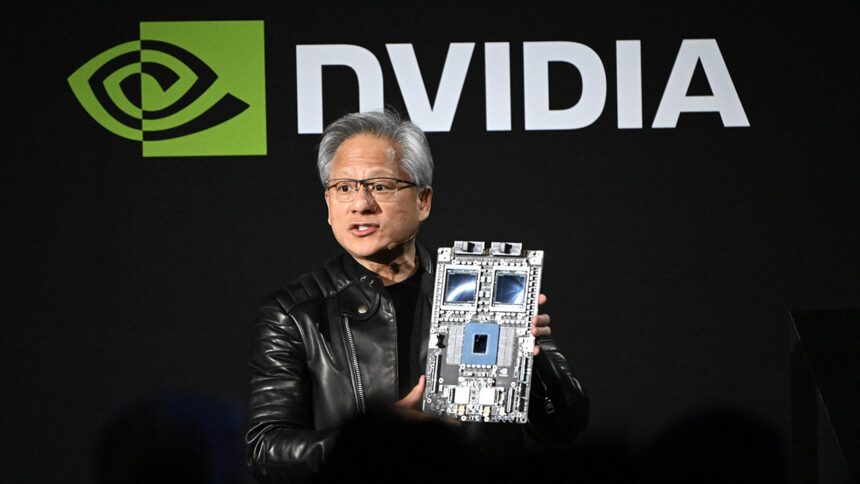

Jensen Huang, co-founder and chief executive officer of Nvidia Corp., holds the AC accelerator chips of the company for data centers. (Akio Kon / Bloomberg via Getty Images / Getty Images)

The company provides for a turnover of $ 43 billion, more or less 2% for the first quarter, compared to the average estimate of analysts of $ 41.78 billion according to LSEG.

| Teleprinter | Security | Last | Change | Change % |

|---|---|---|---|---|

| Nvda | NVIDIA Corp. | 131.28 | +4.65 |

+ 3.67% |

The demand has increased for the advanced chips of Nvidia which can quickly process the large amounts of data used by AI applications, while businesses rush to emerge as leaders of the New technology. Generative AI is a type of artificial intelligence that can learn data and improve over time.

NVIDIA forecasts also help to appease doubts around a slowdown in expenses on its equipment that emerged last month, after the Chinese AI startup Deepseek’s claims That he had developed models of rivaling with Western counterparts at a fraction of their cost.

This could add fuel to the AI Rally of spraying after the Magnificent seven actions’ A tumultuous retirement of their peaks at the end of 2024 while the optimism of Wall Street decreased under the shadow of Deepseek innovations.

Get Fox Affairs on the move by clicking here

Nvidia declared a share of 89 cents adjusted, against estimates of 84 cents per share. Fourth quarter turnover increased by 78% to 39.3 billion dollars, beating estimates of $ 38.04 billion.