(Bloomberg) – Global actions have increased while the threat of closing of the United States government fell, eliminating at least one element of uncertainty confronted with investors. Gold has reached a record greater than $ 3,000 in the middle of the paradise request.

Most of Bloomberg

The S&P 500 contracts increased by 1% while a bill on the financing of Stopgap seemed to say to the congress after the Democratic leader of the Senate, Chuck Schumer, chose not to block the measure. This raised the atmosphere after the index extended its rout of three weeks beyond 10% on Thursday, the technical threshold for a correction. The term contracts on the Nasdaq 100 advanced 1.3% with Nvidia Corp.

“It seems that the budget bill is still going despite an opposition from the Democrats and that it has raised the feeling in the United States and there is probably also an overflow effect for Europe,” said Julius Baer & Co. Sophie Altermatt.

“It could be just a stay, since we had so many uncertainties with erratic policy movements in the United States,” she added.

Avoiding a government closure would remove a concern for merchants, worried threats to the world’s worldwife from President Donald Trump. Two months after Trump’s presidency, 5 billions of dollars were deleted from American actions.

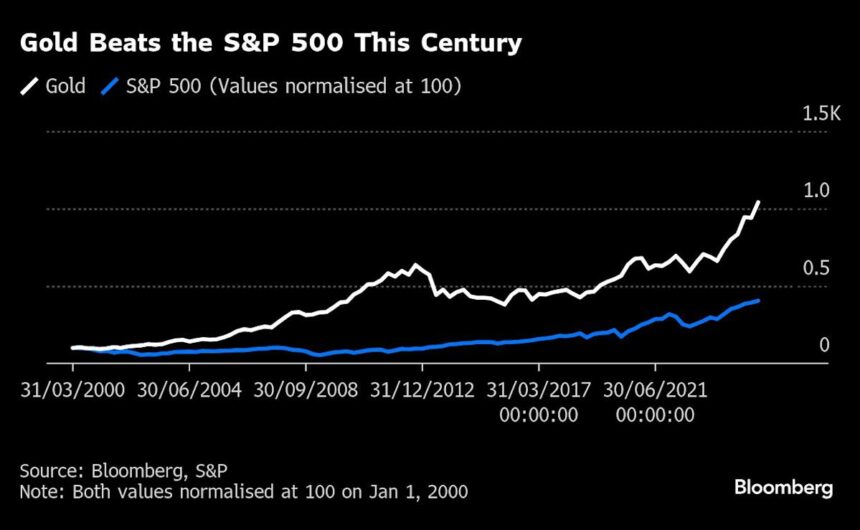

These risks stimulate the demand for paradise assets, the most optimistic investors on treasury bills compared to the shares for at least three years, according to the Bloomberg Markets Live Pulse Survey. They also pushed gold to successive record peaks, the yellow metal up more than 14% of years up to date.

“Gold is in a secular bullish market,” said Peter Kinsella, head of the exchange strategy at Union Bancaire Private UBP SA, who expects prices to reach $ 3,300 per ounce by the end of the year. “Of course, it is the uncertainty caused by American trade policies, but the demand for central banking is also an important factor.”

The Europe Stoxx 600 index has climbed by around 1%, because Friedrich Merz in German, because Friedrich Merz would have concluded an agreement with the green part on a set of infrastructure and defense expenses. The Dax stock market index of Germany increased up to 2.8% while a basket of European defense shares gained 4.5% to a new record.

However, the prospect of more loan has rekindled a sale in the region’s bonds in the euro, raising German loan costs at 10 years of approximately seven base points. French returns have reached the highest since 2011 on the concerns that Fitch Ratings will retrograde the country’s credit rating later in the day.