Stay informed with free updates

Simply register at American inflation myFT Digest – delivered straight to your inbox.

U.S. stocks and bonds rebounded after data on Wednesday showed underlying price pressures in the world’s largest economy were easing more than expected, prompting investors to bet on faster rate cuts. interest this year.

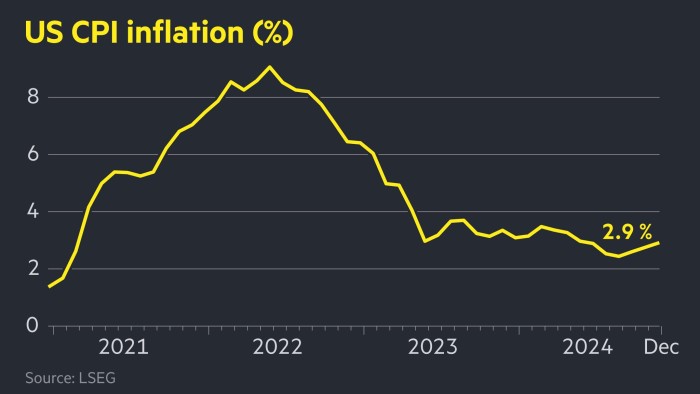

Figures from the Bureau of Labor Statistics indicate that overall annual inflation rose as expected, from 2.7 percent in November to 2.9 percent in December.

But the core inflationwhich does not take into account volatile food and energy costs, fell unexpectedly to 3.2 percent from 3.3 percent a month earlier.

U.S. stock futures and Treasures earned after the publication of the data. Markets have plunged in recent weeks as investors have lowered their expectations that the Federal Reserve will cut rates in anticipation of President-elect Donald Trump’s economic policies, which some fear will be inflationary.

“Today’s CPI should boost markets, easing some of the anxiety that the U.S. is in the early stages of a second wave of inflation,” said Seema Shah, global strategist in head at Principal Asset Management.

Contracts tracking the S&P 500 stock index rose 1.5 percent, while those tracking the tech-heavy Nasdaq 100 index rose 1.8 percent.

The dollar index against six other currencies fell 0.5 percent.

In government bond markets, the policy-sensitive two-year Treasury yield fell 0.08 percentage points to 4.29 percent, while the 10-year yield – a benchmark for costs global borrowing – slipped 0.09 percentage points to 4.7 percent. Yields fall as prices rise.

Fed officials have indicated they plan to take a “cautious approach” to rate cuts amid concerns that inflation will not quickly return to the central bank’s 2 percent target.

Investors are now betting that the Fed will cut rates by July – compared to September before the data was released.

Futures markets now imply a 60 percent chance of a second decline this year, up from 20 percent earlier on Wednesday.

Mark Cabana, head of U.S. rates strategy at Bank of America, said the inflation numbers, including the core number, were likely to “modestly increase” the Fed’s “confidence in continued inflation.” decline in inflation. But he added that policymakers were likely “still generally frustrated by the slowing pace of progress on the inflation front.”

Most investors and analysts believe the Fed will not cut rates again at its next policy meeting later this month. U.S. central bankers have indicated in their own projections that they will cut rates by only 50 more basis points this year.

Trump, who takes office Monday, has outlined aggressive plans to impose tariffs on a wide range of imports, implement a sweeping crackdown on undocumented immigrants and pass drastic tax cuts.

Economists warn that such projects could further boost inflation.