THE Magnificent seven has turned into srendeux because fears of spending of AI weigh on feeling.

The magnificent meta-meta trade (Meta), Amazon (Amzn), Google (Goog), Apple (Aapl), Nvidia (Nvda), Microsoft (Msft), and Tesla (Tsla) Disappointed more than a month until 2025. One of the technological components with large capitalization – Meta – marked two -digit gains outside the box.

In fact, Meta’s actions increased by 15 consecutive sessions until Monday – passing his birthday to a birthday to a stellar (or a formidable …) 20%.

Amazon is the only other Mag Seven component to be underway the year up to 5.9%, slightly ahead of the 3.4% increase for the S&P 500 (^ GSPC). Alphabet, Apple, Nvidia, Microsoft and Tesla are all down to date, with an average decrease of 3% based on Yahoo Finance calculations.

Tesla is the worst performer of the year, down 6% because it was struck with Less than inspiring sales news around the world. Price concerns have also weighed on the stock, similar to other automotive parts like General Motors (GM) and Ford (F).

Digning deeper, six out of seven members of MA seven have so far declared the results of the fourth quarter: all except Meta have been declining since their reports. Alphabet is broken down to 10.4%, because the street reacted very negatively to its initial perspectives in 2025.

“Price reactions suggest growing concerns about monetization against CAPEX for hyperscalers,” said Bofa strategist Savita Subramanian In a customer note on Monday.

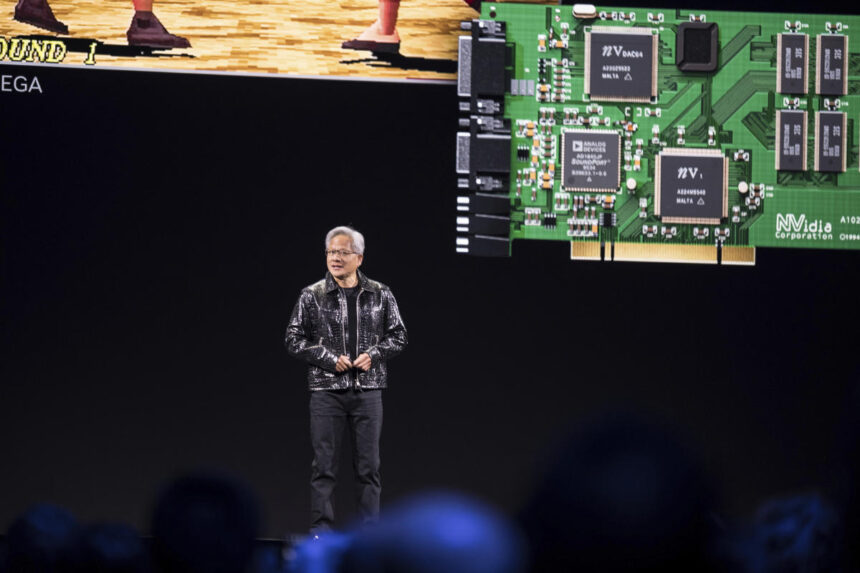

For the subramanian point, the number of capital expenses being launched for 2025 by Big Tech to develop IA infrastructure was breathtaking – and took investors off guard. Collectively, they were worried about if the margins of the Mag Seven reached a short -term peak in 2024.

Meta, Microsoft, Amazon and Alphabet should spend a cumulative of $ 325 billion in capital and investment spending this year, Laura Bratton of Yahoo Finance reports. This would mark an increase of 46% from one year to another for the four technical pillars.

Amazon alone sees $ 104 billion in capital expenses this year, well above the previous forecasts of analysts from $ 85 billion to $ 85 billion.

The RBC capital market analyst Brad Erickson warned last week, the seven names like Amazon are “crowded” professions and that the “AI” debate will spend money “will undoubtedly continue. “”

The question that is now starting to circulate in the street is so Mag seven Lowerness bleeds on the larger market. If this is the case, this could have a disproportionate impact on actions that are not directly linked to technology.