Michael Strain, principal scholarship holder and American Enterprise Institute, explains how President Donald Trump’s prices would immediately have an impact on American consumers, businesses and the global market.

A two -week whirlwind for the Trump administration negotiations on prices left economists to plan the good and the evil that awaits us for the financial health of America.

One of these senior economists and scholarship holder of the American Enterprise Institute (AEI) – where the director of the National Economic Council Kevin Hassett previously worked – expressed his concerns that President Donald Trump’s pricing strategy could prove to be against What it brings to the economy.

“I do not think that there is a doubt, at least in my mind, that a price of 25% on imports from Mexico and Canada would have serious negative economic consequences,” said Michael Strain d ‘ AEI to Fox News Digital.

“The economic effects of these prices are quite clear that they would injure workers, that they would injure households, that they would injure companies and that they would harm the economy overall,” he Added, before recognizing a certain optimism with “a number of aspects of President Trump’s agenda.”

The EU says that Trump’s “unjustified” prices will not remain unanswered “

“Including its plans to increase the production of inner energy, including its objectives for the United States to constitute its position as the world leader in artificial intelligence technologies. So all this is excited. If the president Trump is launching a trade war with Canada and Mexico, if it launched a trade war with the European Union, it will work against its objectives.

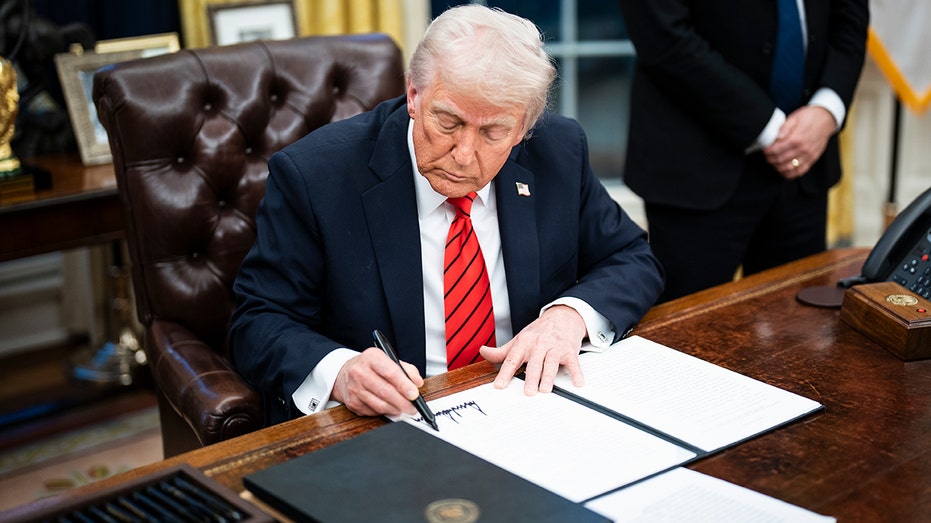

President Donald Trump signed decrees on Monday to impose 25% prices on imported steel and aluminum, the last salvo of his continuous effort to revise the American commercial relationship with the rest of the world. (Getty Images)

A few hours before a midnight deadline, Canada and Mexico barely escaped at their 25% prices By accepting certain border security stipulations with Trump for a 30 -day break. However, a tariff of 10% on China which has transformed into a retaliation levy has entered into force, and an early negotiation call has not yet taken place between Trump and Chinese President Xi Jinping.

Monday evening, Trump imposed a price of 25% on steel and aluminum Since March 12. This decision hopes to allow local American producers to work without intense global competition, which probably has an impact on the nations of the most European Union.

“The objectives he hopes to achieve with the threat of prices on Mexico and Canada is different from the objectives he is trying to achieve with prices on China,” said Strain while stressing that this is the first times in the American history of allies with “enormous” prices to make political concessions or behavior of change.

US Treasury Secretary Scott Bessent unpacking power prices in the world negotiations on “Kudlow”.

But the economist argues that, traditionally, prices increase the prices that consumers pay for imported goods and parts, contribute to inflation and make national manufacturers less competitive worldwide.

“If they should come into force and if companies believe that they will come into force the day they are planned, then American consumers would see price increases very, very soon, in a few days,” said Strain.

“I think that many Americans are very concerned about the effect that these prices would have on their household finances. And they should be,” he continued. “Their grocery products will be more expensive, many products manufactured in America that they would buy will be more expensive, their cars would be more expensive, which would reduce the purchasing power of their salary and their income. And that was going to hit Their wallets.

A recent analysis of Yale researchers revealed that, if it were adopted, Trump prices would create a loss of income of $ 1,170. In addition, A Fox News survey From January 10 to 13 revealed that a majority of Americans expect rates to harm the American economy.

Some commercial and democratic groups have sounded the alarm that Trump putting a world trade war, and to some extent, the economist Aei agrees.

The White House advisor for trade and manufacturing Peter Navarro detailed the “most powerful weapons” that Trump has against inflation, “Mornings with Maria”. | Getty images

“I clearly think that our trade war with China, that President Trump started, increased a little. When President Trump threatened Canada and Mexico with major prices increases, Canada replied by saying that They were going to put their own prices on certain United States, exports, and that, I think, responds to the definition of a trade war, “said Strain.

“In President Trump’s first mandate …, he considerably increased the prices on Chinese imports. China rippled by increasing their rate of prices on American exports of agricultural products to China. Farmers in order to compensate for effects of Chinese reprisals.

MGA Entertainment CEO, Isaac Larian said Donald Trump is a “big” president while expressing certain concerns about the prices on “Claman’s countdown”.

On the largest scale, Trump said that prices provide a way to bring America back to a “Economic gold” Before the invention of federal income tax. But government financing entirely on prices could be a challenge, according to Strain.

“It is quite unrealistic to argue that the United States could replace income tax with an increase in prices. There is simply not enough money to tax imports. In order to compensate for the ‘Money, we would lose by eliminating income tax “,” said economist.

A better solution, he noted, could be less taxing income and consumption more: “But a consumption tax should be structured so that it does not only target imports. Again, it does not There is simply not enough money there.

Get Fox Affairs on the move by clicking here

The coalition for a prosperous Jeff Ferry of America reveals what is essential to develop the American economy on “earning money”.

Overall, the American economy “is very strong” and the federal reserve always has work to do to achieve its inflation objectives, noted Strain while emphasizing the “things that excite them” in Trump’s agenda could be ahead of a pricing game.

“I hope that in four years, the rate rates are lower than those where they are today. I am concerned that the Trump administration could have to get their hands on the hot stove of high prices in order to Learn from the first -hand economic damage, which are as high as the president can make American consumers and households. “

Eric Revell by Fox Business contributed to this report.