Unlock Editor’s Digest for free

Roula Khalaf, editor-in-chief of the FT, selects her favorite stories in this weekly newsletter.

The British government sought to quell the tumult in Britain’s bond markets on Thursday by pledging to stick to its fiscal rules even as borrowing costs rose to their highest level since the financial crisis.

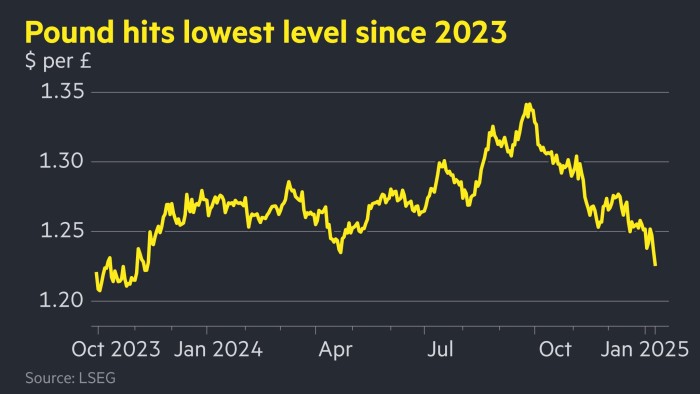

Darren Jones, Britain’s second-in-command at the Treasury, appeared in Parliament to answer urgent questions about market turmoil after 10 years in office. Golden the yield rose to 4.93 percent, its highest level since 2008, and sterling lost as much as 1 percent against the dollar, hitting its lowest level in more than a year.

“The UK Gilts markets continue to operate in an orderly manner,” Jones told MPs. “There should be no doubt about the government’s commitment to economic stability and sound public finances. This is why compliance with budgetary rules is non-negotiable.

Jones’ appearance comes after Sir Lindsay Hoyle, Speaker of the House of Commons, accepted an urgent question from the Conservative opposition regarding the “increasing pressure of borrowing costs on the public finances”.

Chancellor Rachel Reeves, who is preparing to leave on a long-awaited trip to China, dispatched Jones, chief secretary to the Treasury, to respond.

The 10-year yield rose 0.12 percentage points before gilts recovered to leave the yield stable at 4.8 percent. Yields move inversely to prices.

Sterling was swept up in the sell-off, falling to $1.224, its weakest since November 2023, before seeing a partial recovery to $1.228.

“The liquidation in [the pound] and gilts reflect a deterioration in the UK’s fiscal outlook,” said analysts at Brown Brothers Harriman.

Britain’s borrowing costs have risen sharply as investors worry about the government’s heavy borrowing needs and the growing threat of stagflation, which combines lackluster growth and persistent price pressures.

Jones argued that it was normal for government bond prices to vary and that there was still strong underlying demand for UK government bonds.

“The latest auction held yesterday received three times more bids than the amount offered,” he said.

The minister said the Treasury was still working on a multi-year spending review due this summer based on assumptions set out in the October budget.

However, he acknowledged that the Office for Budget Responsibility, the independent budget watchdog, would present new forecasts on March 26, which could then impact discussions with ministers.

Recent tensions in the bond market also raise the specter of higher taxes or reduced spending. The Treasury has indicated that, if necessary, it will cut spending rather than increase taxes.

Shadow chancellor Mel Stride, who asked the urgent question, said Reeves should have attended Parliament herself.

“Where is the chancellor?” he asked. “It is a bitter regret that in this difficult time, with these serious problems, she herself is nowhere.”

He then called on Reeves to cancel his trip to China “and focus on that country instead”, while attacking Labour’s “panicked attempt to reassure markets about the economic mess they themselves have caused”.

Reeves left himself a limited £9.9 billion of leeway from his revised fiscal rules in last year’s autumn budget, even after announcing a tax rise plan of £40 billion aimed at “wiping the slate clean” of public finances.

The chancellor’s key fiscal rule is a promise to fund all day-to-day public spending through tax revenues by 2029-30.

Since then, rising public debt yields have threatened this fiscal space. The level of bond yields is an important determinant of fiscal space, given its implications for the government’s interest bill, which exceeds £100 billion a year.

“Investors are waiting for advice from someone, but the government has just said there is no problem,” said Tomasz Wieladek, chief Europe economist at T Rowe Price. “The Bank of England will hold on for as long as possible,” he added, saying the measures were not important enough to merit anything other than a verbal response from policymakers.

The gilt market could see another round of selling on Friday, analysts said, if closely watched US jobs data were to push US Treasury yields higher, dragging gilts down with them.

“It can get extremely bleak for gilts if we see strong payrolls,” said Pooja Kumra, UK rates strategist at TD Securities.

Analysts said the simultaneous sell-off in gilts and sterling echoed the reaction triggered by Liz Truss’s 2022 “mini” budget.

But many investors believe the situation is far from comparable to the Gilt crisis of 2022.

“I expect things to start hitting rock bottom. . . Regarding Gilts, the collapse already happened last year,” said Geoffrey Yu, senior strategist at BNY. “I don’t deny there are problems in the UK, but suddenly making comparisons with 2022, I think it’s pushing things.”