Whenever I buy a stock, I intend to hold it for three to five years, then to analyze if it is worth it to be held even longer. Over a period of this length, the results of the company should take over as a key factor in the performance of actions rather than the feeling of the short -term market. However, there are a few actions in my wallet that I never intend to sell, unless something radical changes with their investment theses.

Three of the actions on this “Hold Forever” list resemble fairly strong purchases today. They are also strongly involved in the arms race for artificial intelligence (AI) and well placed to take advantage of the massive technological change that we undergo.

Amazon (Nasdaq: Amzn) is a key element in the life of most American consumers. Almost everyone has already bought something on their market, and many people (including myself) make a significant amount of their purchases via their electronic commercial platform.

However, I am more excited by his Cloud Computing companyAmazon Web Services (AWS), which provides calculation power that customers can use to accommodate websites, process data or train AI models. Cloud computing allows customers to execute their business lighter, as they can easily increase or lower the amount of processing power they use, and they do not have to buy or maintain the equipment themselves . AWS provided 50% of Amazon’s operating income in the fourth quarter despite the fact that this represents only 15% of its income.

The search for Grand View provides that by 2030, the Cloud Computing market will increase at an annualized rate of 21% to 2.39 billions of dollars. Amazon is perfectly positioned to take advantage of this massive growth trend. With Amazon having a firm socket on the markets of consumer goods and cloud computing, it is an excellent stock to buy and to hold.

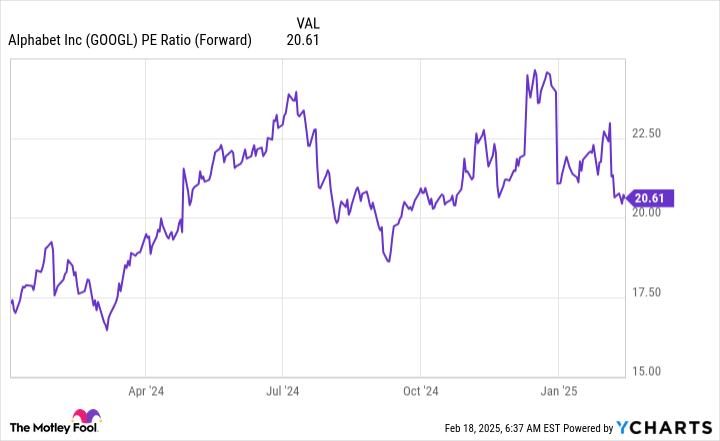

The investment thesis for Alphabet (Nasdaq: Goog) (Nasdaq: Googl) Sharing many similarities with the thesis for Amazon. While Amazon dominates American electronic commerce, the search for alphabet rules with the Google search engine. This inherited company generates a massive sum of advertising.

Alphabet also has a cloud computing segment, and in the fourth quarter, Google Cloud’s income increased by 30% from one year to the next compared to 19% AWS growth. AWS remains much larger, generating $ 28.8 billion in income compared to Google Cloud, which generated $ 12 billion. However, the same rear winds apply to both.

Alphabet has also made important investments in AI, and its generative IA gemini model has become the first interpreter of this space. While some investors feared that the tight grip of alphabet on the research market is weakened because the AI was integrated into the products of its competitors, Google has made similar modifications and has so far maintained its broad advance in space.