American start-ups have been collecting more money than any time since 2021 thanks to the glowing investor about artificial intelligence, but the venture capital market has greatly tilted to finance a handful of large private technological companies.

More than $ 30 billion has already been invested in emerging groups this quarter, according to Pitchbook data. An additional $ 50 billion in fundraising are also by train, because venture capital Work on a series of major offers involving Openai, safe superinity and the start-up of defense technology Andundil.

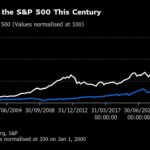

The fervor above the AI has led investors to spend at their fastest rate since the market peak in 2021, a period in which $ 358 billion flooded technological groups, married with a lot of unrealistic valuations.

But VC groups think that this investment cycle will be different. “AI is a transformative force that improves these companies,” said Hemant Taneja, director general of General Catalyst, one of the Silicon Valley The largest venture capital companies.

“Is the way of thinking about it” can these companies reasonably increase 10x from where they are? ” The answer with all of this is yes, so they are at a reasonable price, “he added.

After a two -year collapse, the American fundraising jumped around $ 80 billion in the last quarter of 2024, according to Pitchbook data. This represented the best fourth quarter since 2021. But only six big offers – involving Openai, Xai, Databricks and others – represented 40% of this total, said Kyle Stanford, director of research at Pitchbook

“It is a very elite group of companies that commands investment in venture capital,” he added.

Based on the transactions already concluded and those that should do so in the coming weeks, the first quarter of this year should see similar investment levels – which would make it the best quarter of fundraising since 2022.

In the past two weeks only, Fintech Stripe and Ramp companies have announced warnings of financing to evaluations of $ 91.5 billion and $ 13 billion, respectively. start-ups Anthropic and Shield AI signed offers at $ 61.5 billion and $ 5.3 billion, respectively.

VCS also works on a series of massive investments. OPENAI is in talks with SoftBank to collect $ 40 billion at an evaluation of $ 260 billion, which would be the largest funding of all time, exceeding the investment of $ 10 billion in Databricks at the end of last year.

Andundil, founded by Palmer Luckey, is under discussion to collect at least $ 2 billion at an assessment of $ 30 billion and more, more than to double the assessment it obtained during a financing round last summer, according to two people knowing the problem. Andundil refused to comment.

These more established companies have annual income in hundreds of millions or billions of dollars and increases rapidly. This makes it relatively safe bets, according to Taneja of General Catalyst, who supported Andundil, Anthropic, Rampe and Bande.

“It is so ambiguous where the money will be earned in AI, that many capital end up focusing on companies that are category leaders with clientele and large markets,” he said.

But the excitement concerning AI has also stimulated young companies without income and, in some cases, no product.

The sure superintelligence, launched last year by Ilya Sutskever, co -founder and former chief scientist in Openai, collected $ 1 billion to an evaluation of $ 5 billion in 2024 and is in talks to raise new capital to an evaluation of 30 billion dollars or more, according to two people with direct knowledge of the agreement. It is not yet Announced a product. SSI refused to comment.

The huge funding laps made mark a significant gap in traditional venture capital, which targets emerging companies and is governed by the “electricity law” which indicates the best start-up of a portfolio will pay more than the losses of the rest that fails.

“We have always thought [a venture fund’s] The 50x return will come from an investment in seeds which they leave in the IPO, ”said Stanford de Pitchbook.

In a largely not tested experience, this logic is now applied to companies which are more important orders of magnitude and more developed by a new breed of what Stanford calls “pseudo-vc”.

These include Thrive Capital by Josh Kushner, General Catalyst and Lightspeed Venture Partners, who have all invested in more than one of the great cycles of recent weeks. The three companies are Investment advisers registeredallowing them to invest in a wider range of asset classes and to have companies after their public return.

Each of the three groups also collected funds of more than $ 5 billion, which “gives them” enough to invest in start-ups in an evaluation of $ 1 billion and keep for 15 years up to its value of $ 50 billion, investing in several ways along the way, “said Stanford.

According to Sebastian Mallaby, author of The Power ActThe conviction that even the most expensive start-ups can still evolve by 10 times is what “allows fund managers to rush with great enthusiasm for brand names and say” Who cares about what I pay? ” I am a genius that enters this name. “”

Although the chances of a company established fails are thinner, Mallaby warned, the same goes for the chances that its valuation increases ten or a hundred. “The habits that worked very well in the investment at the start of the stadium must be adapted when you go to much greater towers.”

The big rounds of financing the discussion today represented “a business style completely different from what I have ever known,” said Stanford.

The peak of VC in 2021 was characterized by a rising tide of sizes and round assessments: there were about 854 offers of $ 100 million or more that year, according to Pitchbook. This year, total investment follows nearly 2021, but the market has become more and more unbalanced.

“If you are Openai or Andundil – a high brand and named Brand – you are very well positioned. Money is there for you. . . If you are on the other side, like most companies, money is not there, ”said Stanford.

“Maybe it ends up $ 80 billion [raised this quarter]But $ 40 billion is just a round. . . Even the aberrant values in 2021 were tiny compared to this. »»

Additional reports from Cristina Criddle to San Francisco