(Bloomberg) – SECURITIES AND EXCHANGE US Commission launched the new year with a youthful treatment, cleaning its list of crypto application measures and transforming what was once a hostile landscape for digital assets into a potential paradise.

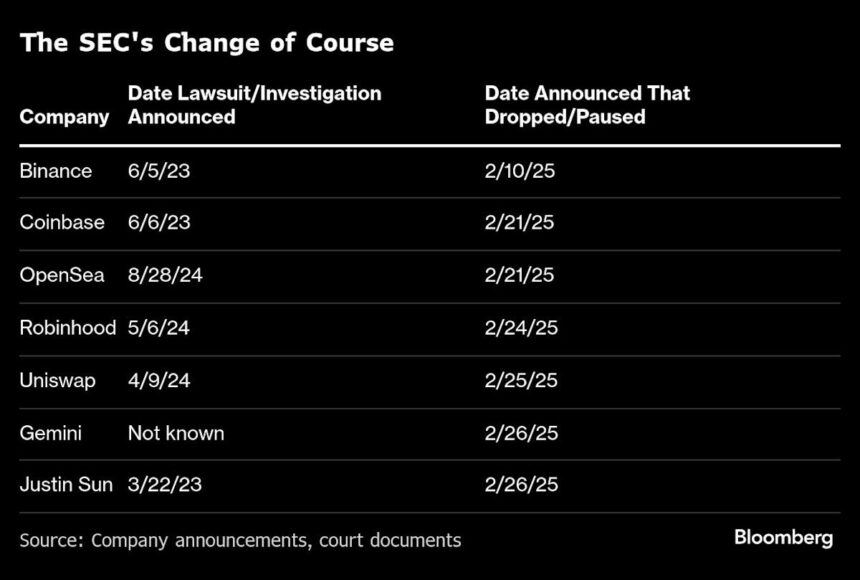

In only the last month, the security dog of securities rejected or interrupted at least eight cases against cryptographic companies, including those which targeted some of the most important faces in the sector. The race count includes large -scale proceedings for the exchanges of Crypto Coinbase Global Inc and Binance Holdings Ltd. – which were prosecuted during the day with each other in mid -2013 – as well as threats of legal action against Robinhood Markets Inc., Uniswap Labs and Opensea.

“This is a multifaceted demolition of the most successful law application program in history,” said John Reed Stark, a former DR -SEC application and now a consultant. After the election of President Donald Trump, Stark said that the agency’s message to the world was: “We will climb a stopping shouting all aspects of the dry crypto application program in a way that is not only unusual and unusual, it is beyond the imagination.”

The guard dog on his face came quickly after the departure of former president Gary Gensler, who moved away at the end of January. It should be replaced by the former SEC commissioner, Paul Atkins, with Mark Uyeda acting in the role while ATKINS awaits confirmation. A SEC spokesperson refused to comment.

On the campaign track, Trump undertook to dismiss people in his first day in power because of his unpopularity in the Circles of the Crypto – one of the many promises made to the industry that financed the return of the republican party to the majority power. His support supported Bitcoin, the most precious asset in crypto, at a record level on the day of the inauguration, although the subsequent political decisions on the prices sent him 25% reduction on the summit.

As the list of abandoned cases increases, managers, analysts and user -friendly crypto regulators expect the innovation to flourish.

“There is, we think, reasons to be gay in the long term,” Alex Saunders, research strategist at Citigroup, in a note on Friday. “Clarity on regulations should offer more opportunities to innovate, strengthen confidence and improve user experience in crypto.”

American call

As part of the Biden administration, the American market was considered by Crypto leaders as a wasted opportunity. Many have spoken out openly against peopleler and its approach to regulate space, which the industry considered tyrannical in its application of securities laws against the sector.

Companies like Coinbase and Ripple have quickly increased hiring efforts abroad, considering other jurisdictions like Europe, the Middle East and Asia as much more friendly towards their commercial strategies. Now, some of these decisions are reversed, Ripple announcing 75% of his roles open on American soil in January.

“It seemed that the dry on a whim could wake up on the wrong side of the bed and decide to provide application measures or file a well notice, or to assign to appear for more information. This fear seems to have disappeared, especially in the light of these layoffs, “said Cathy Yoon, lawyer of Wormhole Foundation, an organization that supports the development of blockchain.

Since its care of the agency on January 21, changes under Uyeda have been immediate. In the space of a month, the SEC has fully replaced its cryptographic division with a new cyber and emerging technology unit, and launched a “crypto working group” dedicated to the development of rules for the sector alongside industry councilors. The future conclusions of the working group are already an integral part of the operation of the agency, being used as the basis of the dry request to suspend its file against Binance last month.

Meanwhile, the intensity of the arguments as to whether the cryptocurrency is a security or a commodity in the eyes of the American law decreased as the threat of execution was upset. Exchanges like Robinhood, who had previously struck down tokens like Solana and Cardano following legal prosecution of the dry naming them as potential titles, quickly reactivated trade for American customers after Trump’s victory. The agency was also more open to the requests for negotiated funds on the stock market linked to these digital assets.

On Thursday, the SEC said that Eascoins – tokens who personify a joke on the internet or a viral moment without promise of public services – are not considered titles in the eyes of its staff. Trump himself launched a same in January, its circulating value dollers dollars before crashing more than 80%. His family is also strongly linked to the WORLD Liberty Financial Interest Cryptographic Platform, which has sold more than a billion dollars in token.

Those who were great supporters of Trump and his companies also saw their cases unloaded by the dry. The agency’s lawyers and Justin Sun, a crypto entrepreneur who has invested $ 75 million in World Liberty Financial, jointly asked in the regulatory procedure against him on Thursday. Crypto Exchange Gemini Trust Co, whose billionaire owners tried to give $ 1 million in Bitcoin to Trump’s campaign last year, said the SEC a day earlier against the company without any action.

The new Dry approach to the regulation of cryptography does not mean that it is a free market for all. The application units of CYBER and Emerging SEC technologies include the guarantee that retail investors have not hidden in cryptographic scams, said Joe Castelluccio, partner of Mayer Brown.

“They are looking for the industry to return to a more traditional American ethics of the Internet, which consists in building things and breaking things, and do not ask permission, ask forgiveness,” said J. Christopher Giancarlo, former president of the Commodity Futures Futures Trading Commission which now advises several cryptographic companies. “There is a major warning to that, and it is not to deceive people.”

The CFTC – which has long been the favorite Crypto regulator – can intensify the activity in this new environment, he added. “Regarding fraud, manipulation and market fault, you will continue to see a very strong application activity,” he said. “Perhaps even stronger because it will be less distracted by continuing companies for technical violations.”

The problems have continued to proliferate in crypto, more recently with the February 21 flight of almost $ 1.5 billion in digital assets of Crypto Exchange bybit. Last month, Argentinian President Javier Milei found himself at the center of a cryptography scandal, after a same, which he praised resulted in around $ 251 million in investors.

“Say what you want about Gary – he may have embarrassed the progress, but he also held the criminal service season,” said Dan Hughes, founder of Blockchain Radix Dlt Ltd. “Pay attention to what you want, I suppose.”

– With the help of Nicola M White and Olga Kharif.

(Add that Sec has refused to comment in the fourth paragraph.)

Most of Bloomberg Businessweek

© 2025 Bloomberg LP